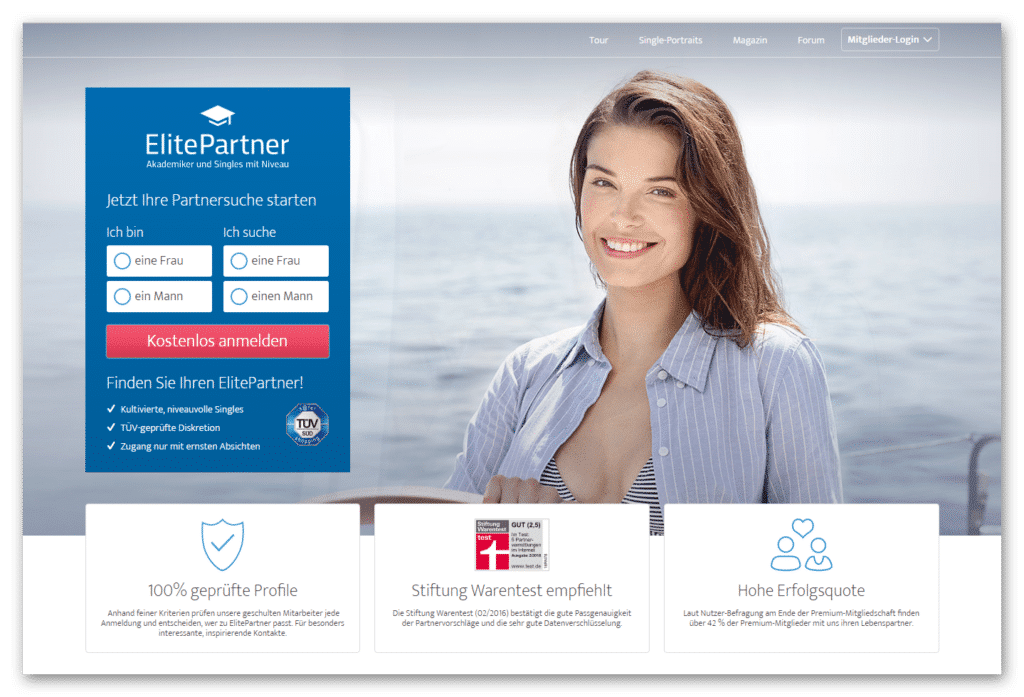

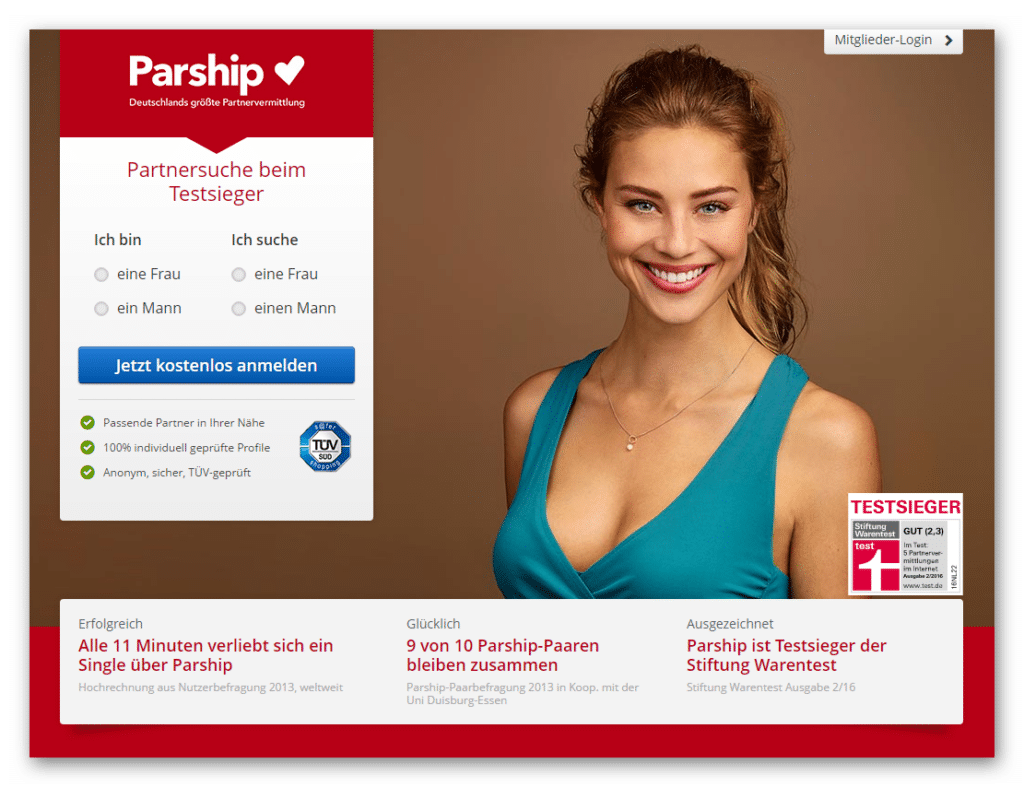

Parship and Elitepartner , probably the largest and best-known online dating agencies currently available on the World Wide Web for finding a partner, have been owned by a common investor for some time. However, according to official information, there is no plan for both providers to merge into one ultimate dating platform.

Photo by Alice Donovan Rouse

(Boston, USA)

The investor emphasizes his intention to continue to make both providers available separately on the network.

Even if the background of these two large partner portals is identical, it is an advantage for members and new interested parties to have two separate platforms available.

The consistent focus on an academic target group is a core feature of ElitePartner. There are also several differences that should be maintained. There is no three-month subscription on the Parship platform, while the Elitepartner site also offers three-month subscriptions.

One common investor, two different portals

In spring 2015, Oakley Capital , a financial investor from London, bought the dating platform and former Holtzbrinck subsidiary Parship. Shortly before, Capital had also taken over Elitepartner from the Burda publishing house.

Suddenly the two platforms, which are often used for online dating and which repeatedly competed for consumers' attention through TV advertising and poster campaigns, were closely linked.

But Tim Schiffers, Parship managing director, confirmed his intention right from the start that he did not want the online platforms to merge.

“It is important to recognize that there are two brands. We have to make sure that the two companies work well together. That must be our goal ,” Schiffers told “Welt am Sonntag” . The Federal Cartel Office approved the purchase.

Looking back on 2015, Schiffers can rest easy. Even if there is a common investor behind the two portals, the separate presence - although there is indeed cooperation between the companies - works satisfactorily.

This is also reflected in various reports from internet comparison portals. The test on Single.info “singles with quality” still being adhered to. It becomes apparent at the latest in the academic quota of 68 percent that Parship cannot yet keep up. The two portals therefore appeal to a different clientele.

The economic policies of the two platforms

“The market for online dating is huge. In Germany you can expect 250 million euros ,” says Schiffer’s forecast for the online dating market . A statement that was made before the Federal Cartel Office's decision. Ultimately, Schiffers wanted to prove that even if the two platforms merged, they would still not have a dominant market position.

However, it can be assumed that the investor can now record a combined annual turnover of around 90 million euros At the time of the takeover, both platforms were also highly profitable and clearly in the profit zone.

There are around 20 million singles in Germany; Parship has around 5 million members . According to company management, one million new members are added every year. At Elitepartner there are around 4 million singles who are looking for a partner. Oakley Capital would now have almost 50% of all German singles under its roof.

The merger of the two brands may also indicate that the dating market has become more difficult. For example, dating apps such as Tinder and Lovoo increased competition for singles looking for a partner.

Above all, with the almost free provision of their functions and significantly more flexible subscription models for premium offers, they are putting a lot of pressure on the top dogs. In addition, the app solutions from Parship and Elitepartner seem less user-friendly, more complicated and more confusing. However, users of Tinder and Co. have to do without the matching algorithms and pre-selection of potential partners.

Trying out Elitepartner and Parship during the 14-day cancellation period is not a real alternative. “reasonable amount” for use . This method is called value replacement. If the users instruct the portals to start the service before the end of the cancellation period, they also accept the calculation of the replacement value.

In this context, the provider also speaks of “black sheep”, i.e. members who register first, use numerous functions of the platform to make contact, and then want to leave the program again within the cancellation period.

A behavior that is not tolerated by Parship, so that one or other member has already had to answer to the judge.

“They are transparent contracts. Every single member knows which conditions have to be met, which points we pay attention to and which regulations there are ,” says Schiffers.

What has changed for customers?

A question that can be easily answered: nothing . Parship or Elitepartner members will probably know, based on various newspaper reports, that there is a common investor behind the two portals and that the companies that work in the background have also merged.

But they still enjoy an independent program. Anyone who has not looked intensively into the structures of the two portals will definitely not have noticed any changes.

However, some are critical of the merger and fear an increase in prices and subscriptions on both platforms becoming more expensive. In our opinion, this remains to be seen, as at the same time price pressure due to increased competition can have a balancing effect on providers.

5